Using the History of the Stock Market to Determine Its Future

People have differing opinions on what industries are most worth investing in the stock market and how much money you should pour into these investments. However, one thing everyone can agree on is that there’s very little that’s certain when it comes to the stock market.

Stocks, industries, and investors are changing on the daily, making it challenging to predict which route will be the most worthwhile. However, looking at past trends in the market can allow us to pinpoint what may happen in the future. Cloud ERP Software manufacturer QAD created a comprehensive history of the S&P 500. Thanks to the interactive graphs we can see exactly what the stock market past as looked like and leverage that to our advantage.

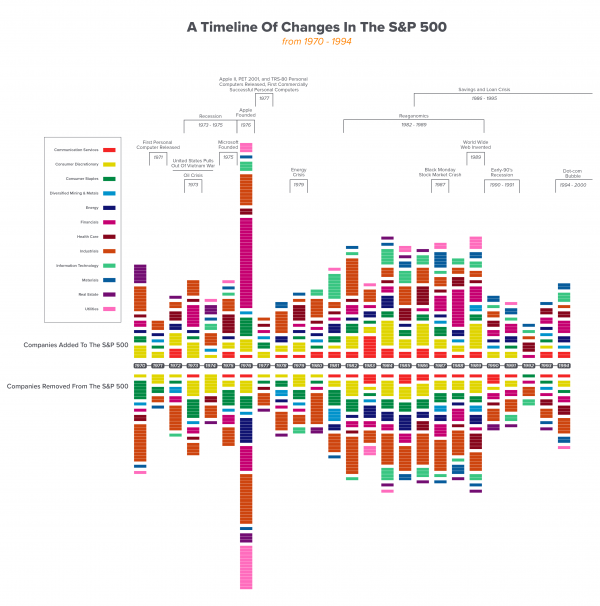

It’s easier to pull out larger trends through grouping companies together based on industry. As society changes, so do the industries that are relevant in the stock market. Companies get added and removed to the S&P 500 constantly. You can see in the timeline below that some industries have companies added to the list much more frequently than they’re removed and vice versa.

QAD.com

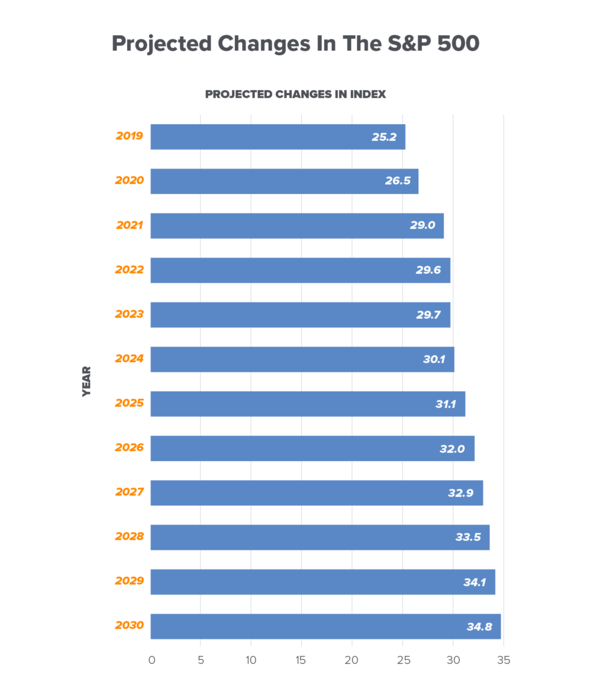

Additionally just because a company lands a spot on the S&P 500, doesn’t mean it will stay there. The average company lifetime on the S&P 500 is currently close to two decades, but this is projected to gradually decrease over time. An approximate 5% projected decrease in average company lifetime each year will bring the mean down to 14 years by 2030 – and this value will likely continue to drop.

QAD.com

Back in the day, companies were generated at a much slower rate making the business much more stable for the ones that were lucky enough to become successful. Now, startups are popping up left and right, thanks to the advancements of technology making this process easier than ever. Companies like AOG Wealth Management work as advisors and so much to guide their clients down a successful path of money management.

But for consumers attempting to invest in the stock market, that makes things a lot more challenging. It can be a risky investment, but can also have a big payout if you do your research.

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).