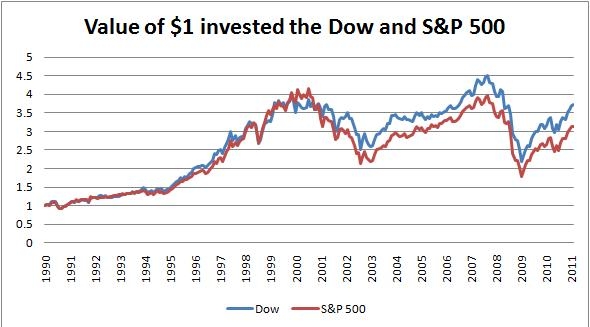

The Dow and S&P 500

When residents of Main St look for news on how the economy is performed that day they often only find reports of how the “Dow” or the S&P 500 performed that day. So what is the Dow? Ditto for the S&P 500?

What is the Dow, and Why Do I care?

The Dow, is the Dow Jones Industrial Average. There the Dow is comprised of 30 large American companies. The thought behind these companies represent the general economy as a whole. With companies like Wal-Mart, Walt Disney, McDonald’s, Coca Cola and Bank of America, these are a proxy for the leading companies in the country.

Now there are some serious flaws with the Dow and looking to the Dow to see how the economy is doing. First, the sample is small and very specific. With only 30 companies, major sections of the economy are missing. For example, no automaker is part of the Dow, and remember how big a part the auto industry played in the recent recession.

Another problem is that the Dow is price-weighted. This means the prices of all 30 stocks are added up to show the value of the Dow. So if each stock is worth $1 dollar, the Dow is $30. If 29 stocks are worth $1 per share, and 1 is worth $71 dollars per share, the Dow is priced at $100. See how this could be misleading? If that one stock worth $71 bucks has a great day and increases to $80 dollars per share, but all the other stocks did so-so, the Dow would look great. The Dow is like a basketball team. Only 5 players. So when the star center is out, it makes a big difference. Hard to hide that because there are so few players.

Why the S&P Matters

The S&P on the other hand is bigger and broader. It takes into account 500 different stocks and is value-weighted. Meaning if Coca-Cola is worth $1 million dollars, that is reflected in the S&P 500’s value. With a broader base, and taking into account the overall value of the companies involved. While the Dow is like a basketball team, the S&P 500 is like a football team. Lots of players, different players (defense, offense and special teams). It’s easier to hide even when the star QB is out. The S&P has energy companies, auto companies and more.

Conclusion

The message? Dig deep into the news of the economy. So much can be learned by looking at multiple sources. How did the S&P do? The Dow? What about energy companies? Banks? Looking into multple sources is a great way to really know what’s going on. And remember, knowing is half the battle.

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).