How Correlation Impacts Your Retirement

An important concept in finance and investing is correlation. Most of us are familiar with correlation. In its simplest form, correlation is a relationship between two or more things.

For example:

- Calories consumed & waist size

- Steroids used by a professional wrestler & bicep circumference

- Price of gas & number of hybrid vehicles sold

- Ice cream sales & temperature outside

- Price of crude oil & price of gas at your local gas station

Think of how the concept of correlation can affect your retirement fund. If you held stock in a car company over the past several years, you may understand this concept without knowing it. Think about a couple of factors that affect the business of Ford, GM and Chrysler:

- Overall economy: The more money people have and are making (see unemployment rate), the more cars are being purchased.

- Gas Prices: As gas prices rose, consumers started looking towards car companies better known for fuel economy (Toyota and Honda).

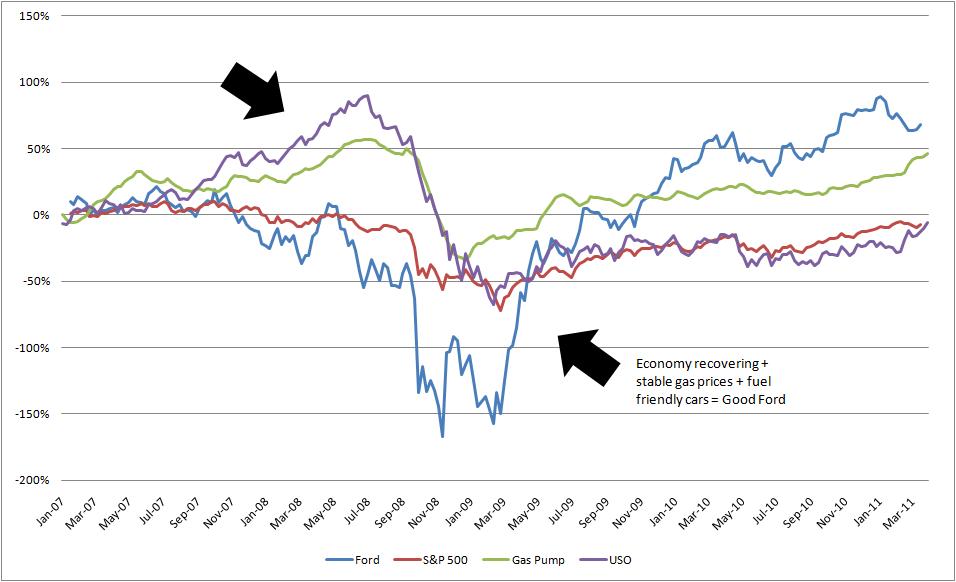

Correlation: Oil & Ford Sales

Let’s take a look at correlation graphically. Below is what correlation looks like:

- Ford: Our subject

- S&P 500: As discussed previously, this represents the general economy. When the S&P is doing well (going up) that means that companies are doing well (cars and TVs are being sold, future looks good), jobs are being created, not lost, etc.

- USO: This is US Oil, basically as crude oil prices go up (like when Middle East is going crazy), so does this.

- National Average of Gas Price: How much it hurts at the pump.

See what I mean? Ford starts falling apart as the market stalls (less cars being purchased as jobs are lost and money is not being made) and oil prices are going up faster than the space shuttle.

On the flip side, Ford survives the recession (read: does not declare bankruptcy), pays off some of its debt, oil prices are lower (read: trucks are okay to buy) and Ford produces some great cars (read: fuel efficiency).

So, when residents of Main Street are looking to invest, remember, not only are investments affected by several factors (some of which are outside of a company’s control) but you MUST factor those things in to an investment opportunity or you may get caught watching gas prices eat up your pocket book and your 401K.

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).