Sunk Cost and Investing

Following up on the idea of sunk cost that we previously discussed, let’s discuss sunk costs (so to speak) in investing.

The thought behind a sunk cost is to eliminate emotions in decision making. Just because you have spent money to start something (as the theory goes), doesn’t mean you need to follow that investment going forward. For example, if a business invests money in establishing better customer service, only to realize that they should stop the program, forget the money invested (as a sunk cost) and turn their attention towards online content because online content will yield more money.

Most of us look at this and think, duh. Of course do the thing that will create more money. Now the problem is if we actually make those decisions when faced with choices to walk away from where we’ve spent money, making us emotionally tied to the decision (to the sunk cost).

Sunk Costs & Your Investments

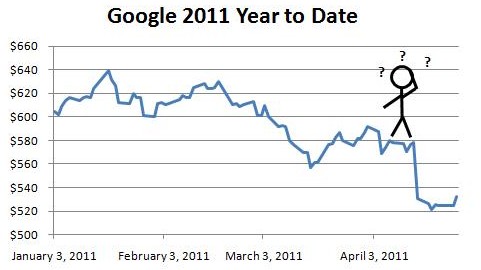

Example: Let’s say you invested in Google to start 2011. You looked at Google, thought about Google and researched Google. You loved it. It was going to make you some money! and then…

Not quite what you imagined? You think “How could I mess up?” and “Well, it’s all about the long term, none of this short term investing!” But are you just setting yourself up to fail? Have things changed? Why did it go down (bad earnings announcement recently)? Those are questions you should be asking yourself, and not just justifying your initial decision and remaining emotionally attached.

How Old Boyfriends are Sunk Costs

Think of your (or your wife’s) favorite chick-flick movie. What’s the one problem that almost always exists? The old boyfriend. There’s a girl (the main character), the guy (the man she needs to end up with) and the old guy (the bum the girl is currently with). So why does she stay with the old boyfriend for 75%-90% of the movie? He’s not funny, doesn’t like what she likes and generally doesn’t make her happy. But she is emotionally attached. She’s invested time (birthdays, dates) and money (presents, living expenses, vacations) on this guy. She can’t give up and start over now, despite there being a better option. Now how many of us actually do what every predictable Reese Witherspoon movie does? Do we actually go with the better option?

Cutting Losses and Moving Forward

Here’s how this relates to investing in Google? Maybe it’s time to cut your losses. Maybe circumstances have changed since Jan (which they have) and you should pull your money out of Google and look at what other options are out there (like currencies which are moving like crazy with the Fed news expected tomorrow).

About admin

The Admin Team at MainStFinance.com focuses on providing the best information related to finance for individuals living on Main Street America.