Learning the Trade of Trading

Invest Time in Investing

As was discussed in the previous post, the best way to save more is not always to spend less, but to effectively use your skills and time. Something that any resident of Main St. can learn to do is invest. We discussed a few ways to invest (in gas, for example), so let’s learn HOW to invest.

You’ve seen the commercials…

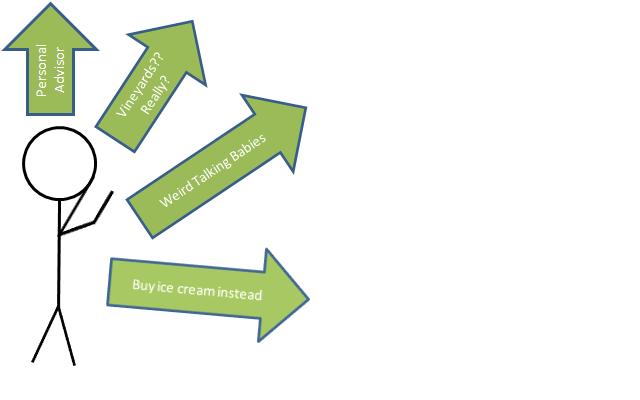

From talking (and possibly annoying, depending on who you ask) babies, to weird semi-animated adults talking about vineyards (I mean a vineyard, come on…). There are plenty of places to invest, so let’s go over a few things when making the decision on where to take your money and how to spend your time.

What matters to you?

Here are a few things to consider before we talk about the different places to go:

- Price: Each place offers different types of services and a result, prices are different. Actually creating an account is likely to be free (just like creating a bank account), but making trades and buying stocks have a cost or commission (I would always go for a place that has $10 dollars per trade or less). If you are utilizing a pure online trade platform (trades executed by you), those are likely your only fees. If you use a financial planner (Ameriprise, for example), commissions can be both for executed trades and based on the amount of money being managed (% of account).

- Research: This is how you go from 0-60 in trading. Certain places will provide better research than others. You can get recommendations, research reports (a report that tells you what to buy or not to buy and why) – but be careful, sometimes these features cost extra (monthly subscription).

- Ability to buy: Some places will let you buy only stocks or bonds, others let you buy options and fancy investments. Make sure you get what you want and have everything available to you that you need to succeed.

- Availability: If you have a personal advisor, you need to know that you can access this person when needed. Online accounts are available at all times (though trading is available during stock market hours, remember that).

- Tutorials: Most trading places offer you tutorials on how to trade (something we will cover next time).

Next time, we will start naming different places to go and offer a review of sorts of these places and how to set up an account. In the meantime, start getting smart and making money.

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).