Emotional Investors

Humans are emotional. That statement is true if you look at the top movies for the weekend (50/50, for example) and it’s true if you watch how investors work. Investors are prone to mistakes based on emotional factors, so let’s take a look at a few:

“I like this company”

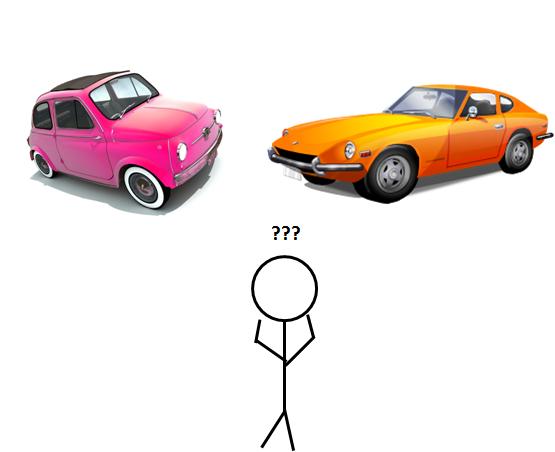

Liking a company doesn’t mean it is a good investment. So just because you shop at it, doesn’t mean you’ll make money by investing in it. The biggest mistake in this category is the “good company syndrome”. Essentially, an individual will invest in a company based on how “good” it is. For example, Home Depot is a “good” company. It’s well established, has a great reputation and is an essential part of the economy. That doesn’t mean it is a good investment. Partly because companies like Home Depot are closely followed. Analysts know EVERYTHING about this company and are predicting fairly accurately what the company will do in terms of sales. For this reason it is likely correctly priced, or close to it. When something is correctly priced, it is harder to make money on it. Think of two cars, a BMW and an old beat up Ford. The BMW is a “good” car, and costs $35,000. You can buy it and turn around and sell it for….$35,000. The Ford, on the other hand, is being sold for $4,000. However, you can sell it to your friend for $5,000. Though not a “good” car, it’s a better investment. Lesson: Find the best investment, not the best company.

I just know I’m right

When an investor finds the perfect investment, because of personal research, they view that investment as infallible. When the stock falls, they hang on. When news gets bad, they hang on. All the while thinking “I just know this will work out”. The problem: just ask any baseball player, no one hits everything. Not Warren Buffett, not anyone. Look at Steve Jobs. Incredible mind, incredible leader, but his past has several fails and misses. The point is to have more wins than losses and to cut our losses. Don’t hang on to something endlessly, just because YOU hate the idea of being wrong. Humility makes for sound investing.

Chasing the dollar

Ever hear the advice “buy low, sell high”? Well you can’t do that if you’re chasing the dollar. Say Apple comes out with a great new product and the stock price goes up as a result. Don’t just jump on the wave…because it’s already gone up. That’s part of the investing game. Figuring out the deals before they happen. Easy? No. It requires work.

Remember, emotions make fore great endings to movies, but can make for classic mistakes in investing.

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).