How European Banks are Hurting Your Retirement

If you’ve been following the market recently, you’ve seen a lot of up and downs that the headlines claim are the result of issues and actions in the Eurozone. Maybe you all have the same question I do…what does the Eurozone have to do with stocks in the US? Let’s take a look at the connections:

Bad Debt:

The first problem is that countries like Greece and Spain (and others) are in danger of not paying their debts. These countries, like a lot of countries, are highly levered (meaning they have borrowed lots of money) but are running low on cash. They don’t have the ability to raise taxes or simply raise the debt level, because they are already reaching limits. Putting these countries in danger of not paying their debts…which would be bad for the companies that are owed money.

Banks own the Debt:

So who exactly do countries like Spain and Greece owe? A lot of their creditors are banks, specifically those in Europe. So the problem would be that these banks would sustain losses and be getting nothing for the money they lent out. Obviously that hurts the banks. The banks then have less value going forward (right now they think they are getting something from Greece and Spain, so they count this as an asset).

What happens when a bank loses money?

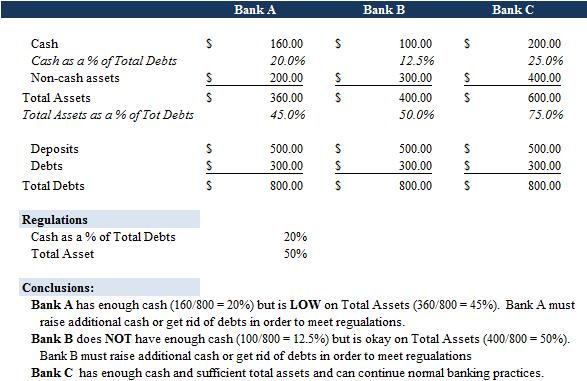

This is a great question, and one that we see happening in the US right now (Bank of America, anyone?). Banks have to keep certain amounts of money on hand. So as people and businesses make deposits in a bank, a bank makes money by lending our investing that money out and making interest on that money. Rules are set in place that prevent banks from lending out 100% of the money deposited in the bank (for obvious reasons). Banks have to keep a certain amount of cash on hand, and that is determined by how much the bank owes, how much the bank has in non-cash assets and certain other requirements. If Greece doesn’t pay its debts, those banks lose out on getting cash and their non-cash assets (in this case a loan to Greece) goes down. The bank would like need to lend less or even raise cash in order to meet regulations. Sounds complex? It kinda is. So look at the diagram at the bottom.

Okay, so a few banks in Europe lose money…how does that hurt the US?

The world economy is closely tied together. If countries in Europe stop paying debts, resulting in bank losses in Europe…that likely means a tougher business environment and economy in Europe. Apple makes money by selling products in the US AND Europe. Lots of US businesses import products from Europe. US businesses and banks even borrow money from European banks or have European subsidiaries. And if Europe is doing poorly, the Euro (Europe’s currency) will fall in value making it tougher for Europeans to buy US goods (basically making it more expensive to buy US goods). Remember…we’re all connected.

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).