What Millennials Need to Know about Retirement

Life comes at you fast. One day you’re in high school, and the next thing you know you’re about to graduate from college and you’ve realized that you’ve totally neglected your personal finances.

Well, it’s time to reassess the state of your bank account, and take responsibility of your fiscal future. One thing you’re going to want to pin down is a solid plan to begin saving for retirement; although it seems a long way off now, you’ll thank yourself later if you make a plan now. The biggest hurdle in saving for retirement, other than the actual act of having the money to save, is setting up an investment account that will bring you the the best return. This poses the question: what type of account should you select?

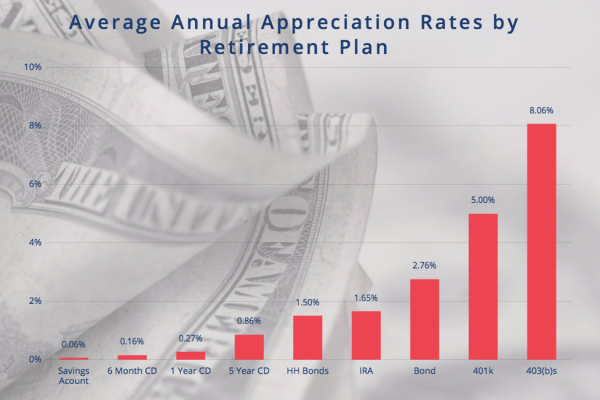

Take a look at this chart:

The average returns provided by each type of account are plotted, leaving the 401(k) and the 403(b)s as the best options if you’re looking to maximize your returns on investment. However, because you’ll need to be employed by a charitable organization, a church, or a public school system to be eligible for a 403(b)s, a 401(k) is the next best thing.

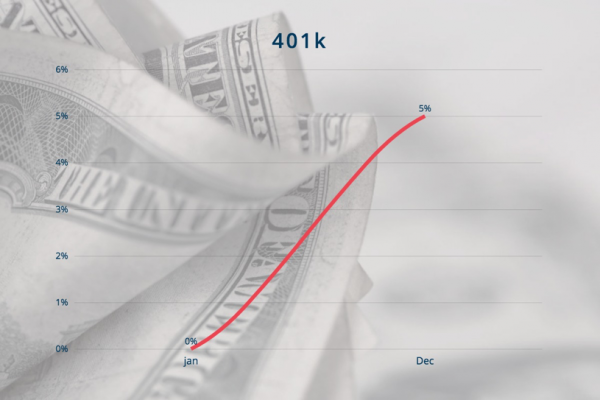

As demonstrated in the below chart, the growth of your money in a 401(k) is pretty simple and steady. At the beginning of the year you put in $100, and by the end of the year, the average 401(k) will have made you $5.

At first, this may not sound like much; but, remember that you’ll (hopefully) be putting in more than $100 a year, and the return compounds on all the money in the account, not just the money you put in that year. In reality, 40 years down the road, with $100,000 in your account, the 401(k) will be averaging a $5k return each year, just for being there. That’s a great way to let your retirement savings grow in a safe and steady manner.

Ultimately, the choice is yours, but a 401(k) is a great place to start your retirement savings. Consider your choices and the appreciation rates of other investment alternatives, but make sure you implement a strategy to save for your future. Now is not too early!

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).