All Hedged In

Having talked about correlation and what can happen when prices go up, what are we to do? Simply watch a tank of gas eat away at our savings or profits like this article? Drive a moped? Ask the woman to drive on a date? Here’s a better idea: Hedge.

Hedging is what all the big boys do. If you think gas prices hurt the average Joe’s pocket, imagine what gas prices do to an airline company like Southwest or as we’ve discussed, our good buddy and truck champion Ford.

Hedging Like Big Business

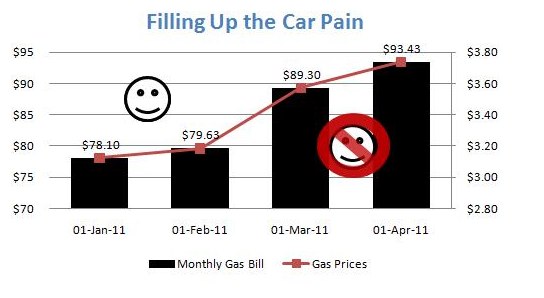

Southwest has to fill the tanks of airplanes and Ford is trying to sell those big trucks with equally big gas tanks. Southwest and Ford do what we all should do, they hedge. To hedge is to offset one’s exposure. Southwest and Ford are exposed when it comes to gas prices. As the prices of oil goes up, Southwest is exposed by having to pay more in gas and Ford is exposed by selling fewer trucks. The general public is exposed by having to pay more for a tank of gas. The graph below demonstrates how we feel when the price of gas goes up!

You’ll notice that the graph just contains data since the beginning of 2011. Look at the increase in gas! Not loving the role of soccer team driver anymore are you?

You’ll notice that the graph just contains data since the beginning of 2011. Look at the increase in gas! Not loving the role of soccer team driver anymore are you?

What You Can Do To Offset Your Exposure

The solve this problem we need to do what the big boys do. We need to hedge! Southwest hedges by investing in oil. Meaning that as the price of oil goes up, so does the value of their investment. Southwest might being paying more for gas, but Southwest can pay for it using the proceeds from their investment in oil.

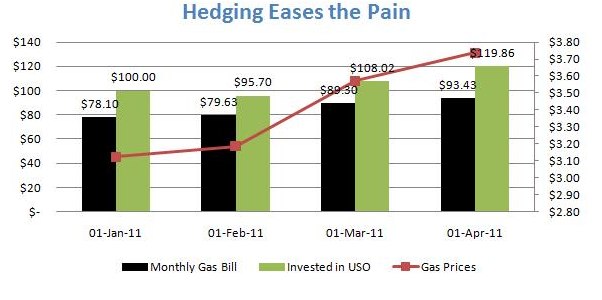

You can do the same thing. Take a look at this investment: United States Oil Fund LP (Symbol: USO). As the prices of Oil goes up (due to war in an oil rich company, for example), so does this investment. If you took $100 and bought USO to start the year, as of April 4th, you’d have $119, meaning a profit of $19.

Since the start of the year the cost of a tank of gas is more expensive. But just like Southwest, You’d have $19 extra bucks to overcome the cost of a tank of gas. Now lets look at our graph, but with data for an investment in USO:

Lesson to be learned: Figure out your exposure (financially speaking…) and cover it up by hedging.

About Andrew

Andrew is a corporate finance consultant living in Los Angeles, specializing in distressed and bankrupt consulting. He helps clients review business plans and the general market and decide what steps to take next. He has a masters in finance. Andrew enjoys running and biking in the San Gabriel mountains, cheering for the San Francisco Giants and eating (but trying not to gain weight).